American Land Reserve

Private Access to Discounted U.S. Land Assets

Curated vacant land acquired below current retail market value, offered exclusively to qualified investors.

No tenants. No rehabs. No leverage required.

The Problem

Real estate isn’t short on capital.

It’s short on discounted inventory.

MLS deals are picked over

Auctions are competitive

Marketing and diligence consume time

Entry prices leave little margin

Most investors don’t lose money on execution —

they lose it at purchase.

Our Focus

American Land Reserve exists for one reason:

To source and control off-market land at disciplined entry prices.

We acquire vacant land nationwide and underwrite each asset with:

Margin

Liquidity

Exit flexibility

No appreciation assumptions required.

Direct-to-owner sourcing (not marketplaces)

Target pricing at 25–40% of retail value

Vacant land only — no operational drag

Multiple investor-friendly states

Clear pricing, no bidding wars

Flexible exits: flip, finance, or hold

This is controlled inventory — not a listing site.

What Makes This Different

Featured Properties

20 Acres

Alamosa, Alamosa County, CO

In the Path of Growth

40 Acres

Montello, Elko County, NV

Powerlines are Available at the Property

5 Acres

Ramah, Cibola County, NM

No Restrictions - Near Albuquerqu

Who This Is For

This is for investors who:

Understand basis and spread

Have capital ready to deploy

Want simple, scalable assets

Prefer optionality over complexity

This is not for:

Retail or lifestyle buyers

First-time investors

Education seekers

Speculators chasing hype

Direct-to-owner sourcing (not marketplaces)

Target pricing at 25–40% of retail value

Vacant land only — no operational drag

Multiple investor-friendly states

Clear pricing, no bidding wars

Flexible exits: flip, finance, or hold

This is controlled inventory — not a listing site.

Our Philosophy

How It Works

Off-market land sourced nationwide

Conservative underwriting

Inventory released privately

Investor chooses exit strategy

Simple. Repeatable. Disciplined.

Experience

Our team has completed thousands of land transactions across the U.S., with over a decade focused exclusively on vacant land.

We understand counties, pricing inefficiencies, and liquidity — because this is all we do.

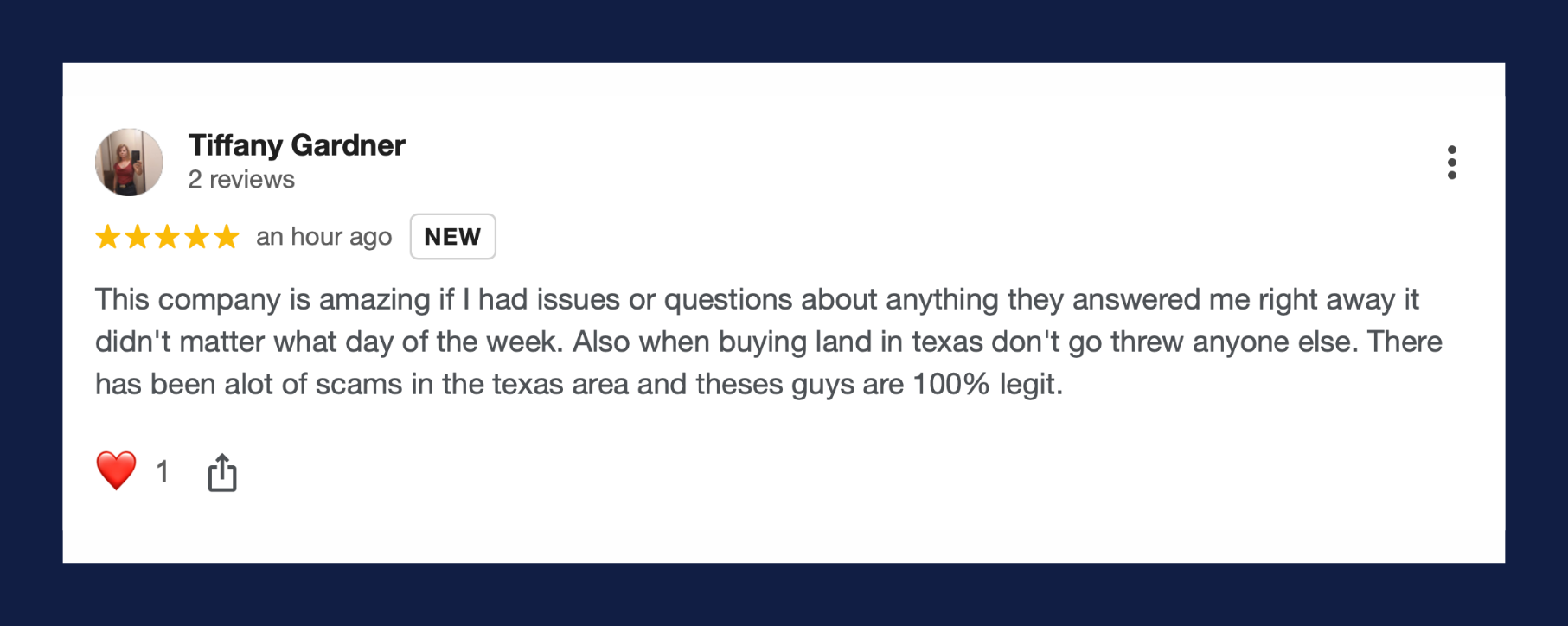

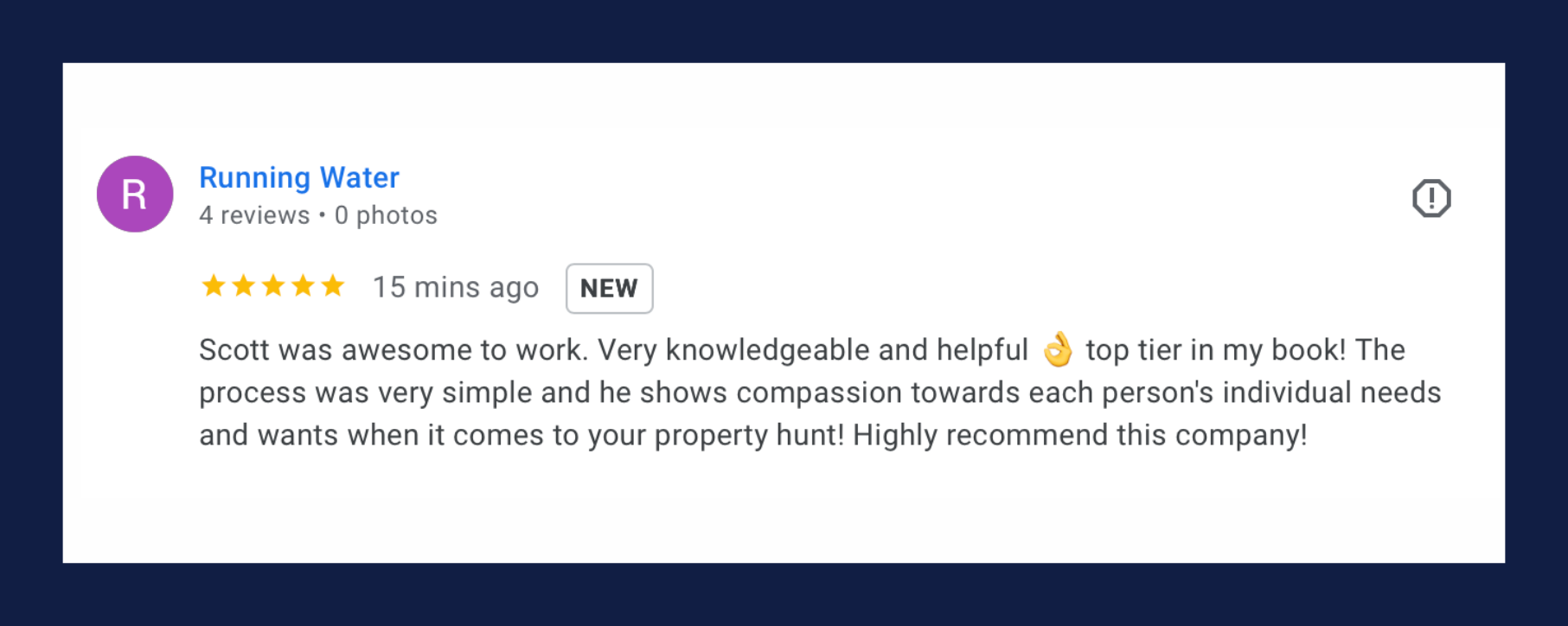

From Our Investors

Access Is Limited

American Land Reserve is not public.

Inventory is released privately to investors who understand the asset class and can move decisively.